Construction products manufacturers report positive Q1 after state of trade survey.

Construction product manufacturers reported a positive start to 2022, recording a seventh straight quarter of growth in sales in Q1, according to the Construction Products Association’s State of Trade Survey. Broad cost pressures remained across the sector but are yet to dent manufacturers’ expectations for growth in the year ahead.

In Q1, 43% of heavy side manufacturers and 50% of light side manufacturers reported that sales increased compared to 2021 Q4. Alongside this, all firms surveyed on both the heavy side and the light side reported an annual rise in costs. For the heavy side, this was the third consecutive quarter of universal cost increases.

Energy, fuel, raw materials, and wages and salaries were all reported higher in Q1, reflecting the rise in global commodity prices in 2021 and further volatility following Russia’s invasion of Ukraine in February, as well as domestic supply issues for materials and labour. Manufacturers anticipate inflationary pressures will remain near-term, but nevertheless, further sales growth is expected during 2022, according to 80% of heavy side firms and 77% on the light side.

Rebecca Larkin, CPA Senior Economist said: “Construction product manufacturers are now facing a sustained and intense period of rising input costs, with the Russia-Ukraine conflict compounding the rise in energy costs experienced at the end of last year. Whilst this is particularly pertinent for energy-intensive heavy side manufacturers of materials such as bricks, cement and steel, energy costs were reported higher for all light side manufacturers too.”

She also adds: “This comes on top of rising costs for fuel, materials, and labour, not just for manufacturers, but across the construction supply chain. Near-term demand is viewed as strong and although broader inflationary pressures across the economy threaten to erode business and consumer confidence and, ultimately, demand in key construction sectors, manufacturers’ expectations for growth this year remain buoyant given the high levels of activity currently on the ground.”

Key survey findings include:

- A balance of 43% of heavy side firms and 50% of light side firms reported that construction products sales rose in Q1 compared with the previous quarter, the seventh consecutive quarter of growth

- On balance, 80% of heavy side manufacturers and 77% of those on the light side anticipated a rise in sales over the next 12 months

- All heavy side manufacturers reported an annual increase in costs in Q1, the third quarter there has been a 100% balance

- Costs for fuel, energy and raw materials rose for all heavy side manufacturers

- All light side manufacturers also reported an annual rise cost, the first 100% balance in five years

- All manufacturers on the heavy side and 91% on the light side expect a rise in costs over the next 12 months

Overall, despite the increased pressure of higher costs and inflation, the construction products manufacturing industry has seen a strong start to Q1. Growth in sales is expected to continue during 2022, albeit alongside further upward pressure on input prices.

Here is a more detailed look at the State of Trade Survey.

For further reading, here is an interesting article relating to escalation in material prices, that may be of interest.

--CIAT

[edit] Related articles on Designing Buildings

- Code for Construction Product Information CCPI.

- Considerate Constructors Scheme.

- Construction Industry Council.

- Construction industry institutes and associations.

- Construction Products Association (CPA)

- Construction Products Association State of Trade Q1 2022

- Contractor vs supplier.

- LEXiCON.

- Persistent identifier.

- Post-Grenfell product code combats misleading marketing.

- Product manufacturers must regain confidence.

- Strategic Forum for Construction.

- Supplier.

- Supply chain.

- The Building Centre.

Featured articles and news

Insights of how to attract more young people to construction

Results from CIOB survey of 16-24 year olds and parents.

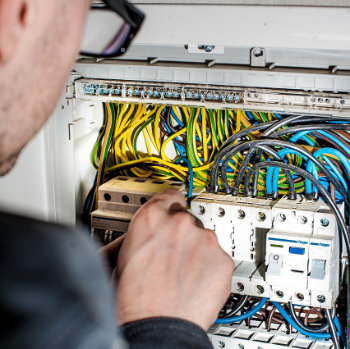

Focussing on the practical implementation of electrification.

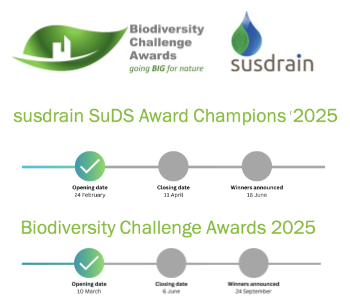

Sustainable Urban Drainage and Biodiversity

Awards for champions of these interconnected fields now open.

Microcosm of biodiversity in balconies and containers

Minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.